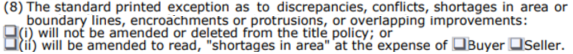

In many real estate contracts used these days, realtors make the selection on whether a buyer will get Area and Boundary coverage as part of their transaction. If they are using the Texas Real Estate Commission contracts they use this paragraph to make the election:

When the realtors make an election in this paragraph, it is not uncommon for them to make the decision on this versus discussing the coverage with their client so that the client can make an informed decision. It may be that the realtor has a personal opinion about the coverage, it could be that they may not understand the coverage, or it could be viewed as a small detail amongst all the details in a transaction. Unless a realtor firm has a set company policy on this topic, there is room for risk for the buyers here.

Fast forward to post-closing and think about the buyer that has a claim issue and could have benefitted from the coverage at closing. Could they successfully argue that a title company had an obligation to disclose to the buyer what was being waived since the title company is the expert on title insurance? I think they can and a prudent title company should protect themselves accordingly. This can be done by explaining the coverage to the client and providing a waiver that can be signed at closing to (1) evidence their informed consent and (2) give the buyer one more change to waive the coverage or change to add it to their owner’s title policy.

The next question becomes - how comfortable are you and your staff in explaining how this coverage functions in a “safe” way that does not create liability for your company? Let us start with the understanding that all matters shown on Schedule B of the title commitment are exceptions – meaning things that will not be covered by the title policy. A standard title policy has the following exception in Schedule B (Item #2):

- "Any discrepancies, conflicts or shortages in area or boundary lines, and any encroachments, protrusions, or overlapping of improvements."

This means if any of the issues listed above become a problem for the buyer, those items are not covered in the title policy. Assuming an acceptable survey (and a Residential Real Property Affidavit T-47, if using an existing survey) is provided and the premium is paid, the exception in the policy is changed to read as follows:

- "Shortages in area."

When a buyer elects to have this coverage it essentially deletes the exceptions initially shown in Schedule B(2) and adds back coverage against those matters. Area and Boundary coverage (also commonly known as “survey deletion”) provides the buyer with coverage against an inaccuracy in an existing survey being used for closing if a covered risk is discovered after closing. That can be an important detail because an existing survey used in a transaction generally does not provide recourse against that surveyor for a subsequent purchaser. Even if a new survey is done in the transaction Area and Boundary coverage still provides a buyer with insurance for issues related to a boundary line or other unseen issues as described below.

When discussing the coverage with a buyer, it is a good idea to share examples of items that have been covered instead of telling them definitively what it covers. You could say something like “some common examples of coverage may include:

- A neighbor has improvements encroaching onto your property;

- A dispute with the neighbor regarding the location of the property line;

- A neighbor is claiming your improvements protrude into their property;

- A surveyor errors in locating improvements or the boundary lines of a property;

Once you have provided some detail about what the coverage could include, you should make sure that the buyer signs a waiver if they are not going to have this additional coverage in their title policy.